UK Tax Calculator

Guide to Using the UK Tax Calculator

The UK Tax Calculator is simple and user friendly tool designed to help all the UK nationals and other individuals across different regions those are interested in pursuing their careers in the United Kingdom, to calculate the total annual tax system. This will allow them to make informed decision regarding their financial matters and may also decide whether United Kingdom is a suitable state for them to spend the rest of their lives or not.

This will also help the users to understand what type of benefits they are going to get if they fulfill the tax requirements of UK. This will help them to understand the benefits and perks the UK government promises to its citizen in return of the tax.

So, before we dive into the details of using this calculator, let's have a breakdown of the content to make it easy for all the users to understand the guide and make better use of the calculator. Here is the breakdown.

Table of Contents

What is the UK Tax Calculator?

The very first step is to understand what is the United Kingdom's Tax Calculation tool. Basically, it's a tool that will allow the users to estimate how much tax they are going to pay on their income. So, the basic purpose of this calculator is to help the individuals get information regarding the liable tax they are gonna pay annually.

How to Use the UK Income Tax Calculator?

The usage of this calculator is easy and consist of few simple steps. The steps that need to be followed while using this tool are:

- Input Your Total Income

- Calculate Tax

- Review Your Tax Results

Input Your Total Income

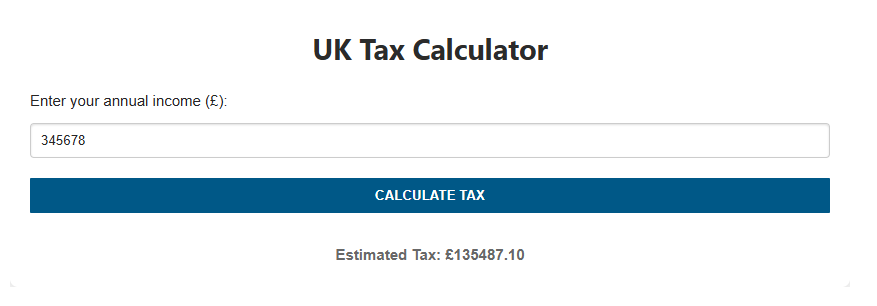

Please input your total income in the input box labelled as "Enter Your Annual Income (£)". Make sure that you are writing your total income in the British pounds, because this tool only supports the British Pounds currency. Please enter the total amount you earn in a year. This will be the amount you earn without any deductions or tax payments from the government sector or any other responsible body.

Calculate Tax

The second and most important step after inputting the details of your annual income in the input section, is to tap the Calculate Tax button. The UK tax rate calculator will process your data accordingly and will display the output instantly just below the Calculate Tax button. We repeat please make sure you have entered your annual income considering the British Pounds, as other currencies are not supported.

Review Your Tax Results

After giving the tool command to calculate the Tax, the final step is to understand the results of this calculator. As understanding these results will help you to plan accordingly for your future and make informed decisions.

The British Tax Calculator uses the standard income tax bands while calculating the applicable tax on your income. According to these bands, the personal allowance of almost 12500 pounds is tax free, while the tax for income between 12,570 and 50,270 is 20% of the total income. For higher income, between the 50,270 and 150,000 pounds, you are liable to pay a total tax of 40% annually. It is 45% for the income above the 150,000 pounds threshold.

Conclusion

This UK annual salary calculator and tax estimator is an integral tool for anyone who is gonna plan their financial assets for the UK tax. This will also help to understand how your salary impacts the total tax you are going to pay if you are staying permanently or temporarily in the United Kingdom.

In case you are more interested in getting valuable information about the UK tax system, please click.

Please do not hesitate to reach us in case of any questions or suggestions via the Contact Us Form. We are always there to help you out in any issue faced while using our tools.

Do not forget to try our similar calculators by clicking here.